Introduction to TDS :

- To collect tax from source of income

- The Deductor to deduct tax and remit to the Government

- The Deductee can claim the credit on the basis of Form 26AS or TDS Certificate

- TDS to be deposited by 7th of Every month.

- Non payment/Non deduction of TDS:-

Sections under TDS :

The following are the list of sections under which TDS can be deducted:-

Payment of TDS :

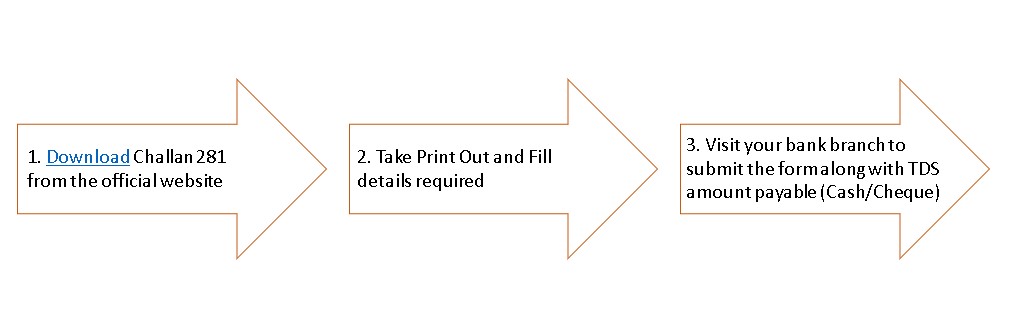

We can Pay TDS in the following 2 methods:-

Following are the Pre-requisites:-

- Laptop/PC/Cyber Cafe with Internet Connection

- TAN of the Deductor

- Amount of TDS Deducted and interest if any

- Whether Company/Non-company Deductee

- Section of Deduction

- Type of Payment

- Net Banking

- AY ( Assessment Year )

- City/State/Pincode

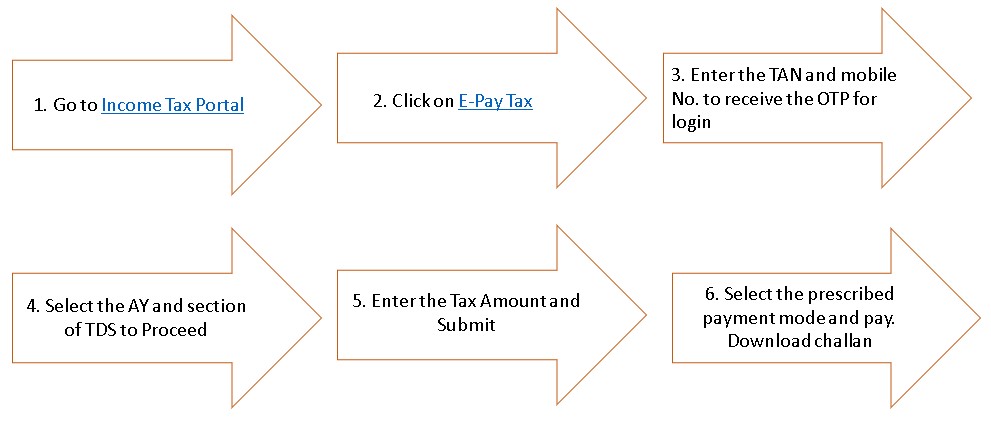

Electronic Mode (1st way)

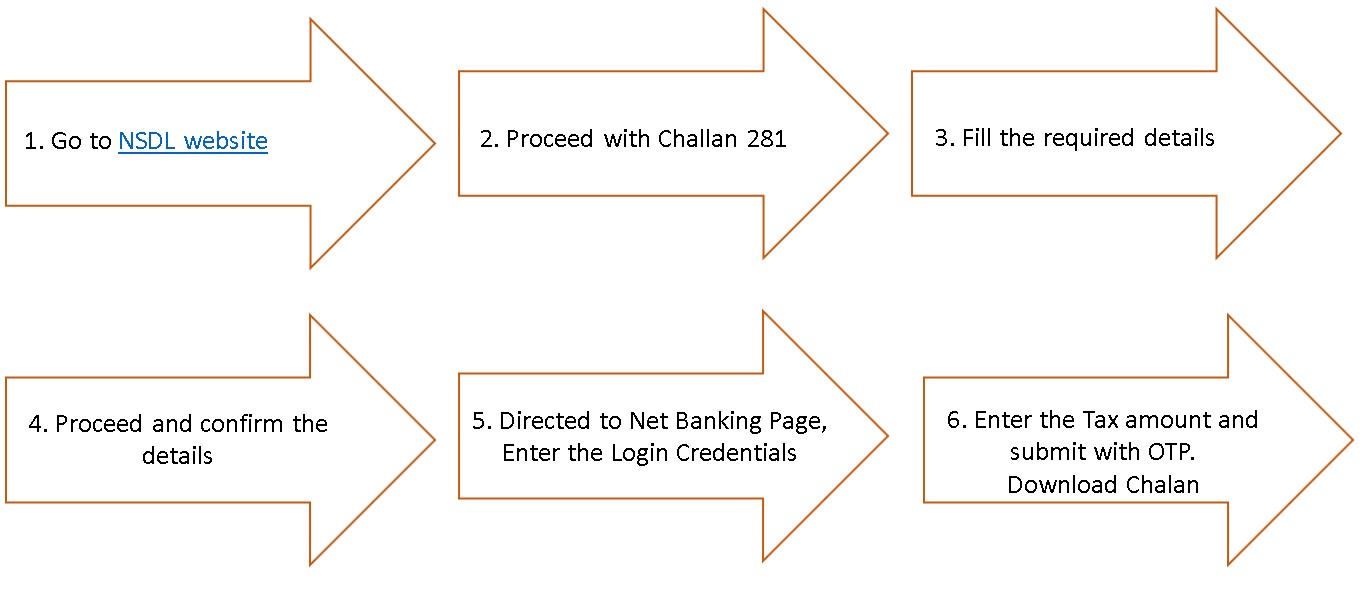

Electronic Mode (2nd way)