- Introduction.

- Flow of GST.

- Reverse Charge.

- Liability to Pay under RCM

- Time of Supply of Services under Reverse Charge.

- Input Tax Credit

Introduction :

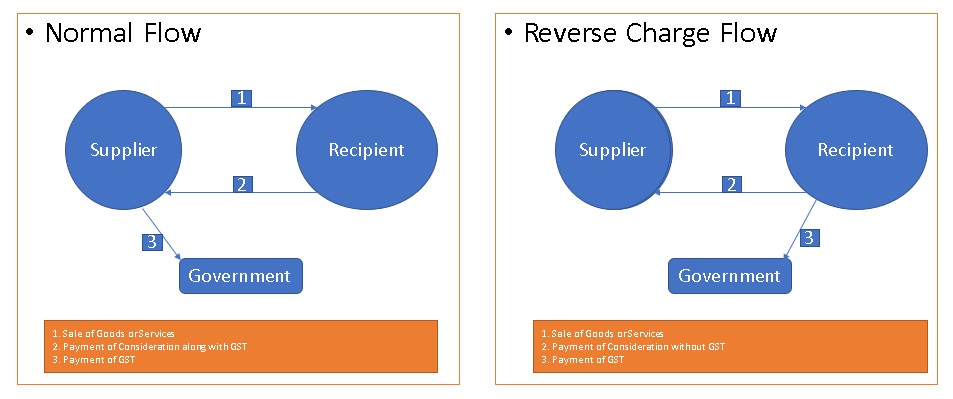

- Under GST, usually the supplier of goods or services has to pay the tax to the Government.

- However, under the Reverse Charge Mechanism, the liability to pay GST is cast on the recipient of the goods or services.

- Reverse Charge Mechanism means the liability to pay taxes lies with the recipient of the goods or services in respect of notified categories of supply

Flow of GST :

Reverse Charge :

- Sec 2(98) of the CGST Act, 2017 states that reverse charge” means the liability to pay tax by the recipient of supply of goods or services or both instead of the supplier of such goods or services or both under sub-section (3) or sub-section (4) of section 9, or under sub-section (3) or sub- section (4) of section 5 of the Integrated Goods and Services Tax Act;

- Sec 9(3) & 5(3) states “The Government may, on the recommendations of the Council, by notification, specify categories of supply of goods or services or both, the tax on which shall be paid on reverse charge basis by the recipient of such goods or services or both and all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to the supply of such goods or services or both”

- Sec 9(4) & 5(4) states “The Government may, on the recommendations of the Council, by notification, specify a class of registered persons who shall, in respect of supply of specified categories of goods or services or both received from an unregistered supplier, pay the tax on reverse charge basis as the recipient of such supply of goods or services or both, and all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to such supply of goods or services or both.

Liability to Pay under RCM :

- The time of supply is the point when the supply is liable to GST.

- One of the factors relevant for determining time of supply is the person who is liable to pay tax.

- In reverse charge, the recipient is liable to pay GST. Thus, time of supply for supplies under reverse charge is different from the supplies which are under forward charge.

Time of Supply of Goods under Reverse Charge :

As per Section 12(3) of the CGST Act, 2017 in case of supplies of goods in respect of which tax is paid or liable to be paid on reverse charge basis, the time of supply shall be the earliest of the following dates, namely :-

- date of receipt of goods; or

- date of payment as entered in the books of account of the recipient or the date on which the payment is debited in his bank account, whichever is earlier; or

- the date immediately following 30 days from the date of issue of invoice or any other document, or similar other document thereof by the supplier

Provided that where it is not possible to determine the time of supply under clause (a) or clause (b) or clause (c), the time of supply shall be the date of entry in the books of account of the recipient of supply.

As per Section 13(3) of the CGST Act, 2017 in case of supplies for Services in respect of which tax is paid or liable to be paid on reverse charge basis, the time of supply shall be the earliest of the following dates, namely:-

- the date of payment as entered in the books of account of the recipient or the date on which the payment is debited in his bank account, whichever is earlier; or

- the date immediately following 60 days from the date of issue of invoice or any other documents, similar other document thereof by the supplier :

Provided, where it is not possible to determine time of supply by using above methods under clause (a) and clause (b), the time of supply shall be the date of entry in the books of account of the recipient of supply.

Input Tax Credit :

- A supplier cannot take Input Tax Credit of GST paid on goods or services used to make supplies on which the recipient is liable to pay tax under reverse charge.

- The recipient can avail Input Tax Credit of GST amount that is paid under reverse charge on receipt of goods or services by him.

- GST paid on goods or services under reverse charge mechanism is available as ITC to the registered person provided that such goods or services are used or will be used for business or furtherance of business.

- The ITC is availed by recipient cannot be used towards payment of output tax on goods or services, the payment of tax under reverse charge only on cash.